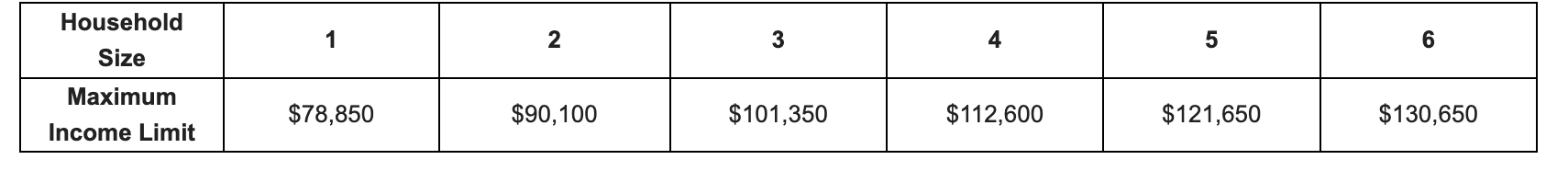

Interested in owning your own home? We have an opportunity designed to assist you in making that happen! You may be eligible if you are a first-time buyer and your family income is at or below 120% Area Median Income (chart below).

The Northwest Dayton Pathway to Homeownership program (Pathway) is a partnership between County Corp and key community organizations and foundations to develop homeownership opportunities for qualified first-time, income-eligible buyers. Our goal is to build 30 new homes in Northwest Dayton to help alleviate the region’s housing shortage and to create opportunities for families to build generational wealth through homeownership. This effort is conducted in parallel with other community initiatives designed to strengthen neighborhoods and families.

The Pathway Program leverages residential lots donated by the Montgomery County Land Bank and the City of Dayton and a public/private/philanthropic funding stack to build new single-family homes in target neighborhoods. Interested individuals may receive individualized coaching and advising that will prepare them for homeownership, and guide them on the financial path to becoming mortgage ready. Down payment assistance may be provided to ensure affordability.

To participate in the program, individuals or households must meet eligibility requirements and agree to certain restrictions on the use and sale of the property (deed restrictions).

- Must be at or below 120% area median income for Montgomery County. Please see 120% Area Median Income Chart by Household Size below.

- Must be a first-time homebuyer (or have not owned a home within the past three years).

- Must commit to completing the required financial literacy program, including:

- 8 hour homebuyer education

- 1-2 hour homebuyer counseling

- Post-purchase home maintenance class